キャプティブ事業

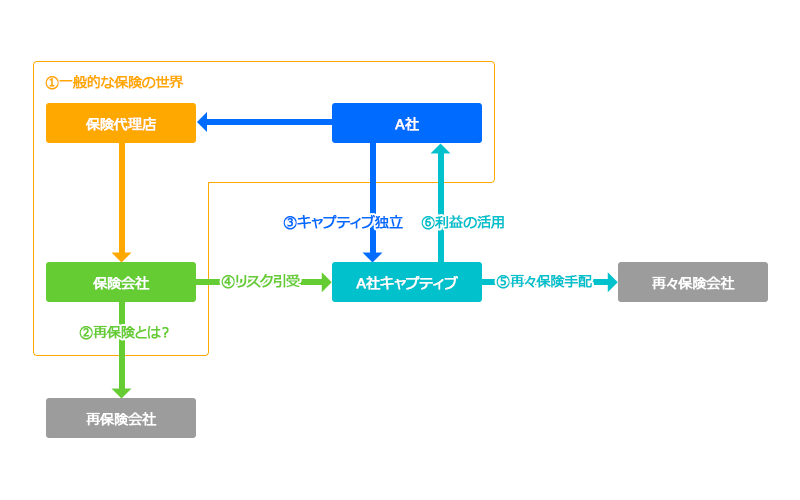

キャプティブとは、自社及び自社グループのリスクを専門的に引受ける再保険子会社です。 おもにミクロネシア連邦、ハワイ、バミューダ等のキャプティブ保険会社法が整備された国・地域に設立され、再保険の仕組み(※1) を利用してキャプティブでのリスク保有が行われます。

多くの企業は保険会社に自社のリスクを移転する為に各種保険を手配し、そのコストとして保険料を支払います。 キャプティブを活用する場合は、保険会社へ移転したリスクと保険料の一部を再保険の仕組みを使って、再度キャプティブへ移転し自家保険化します。

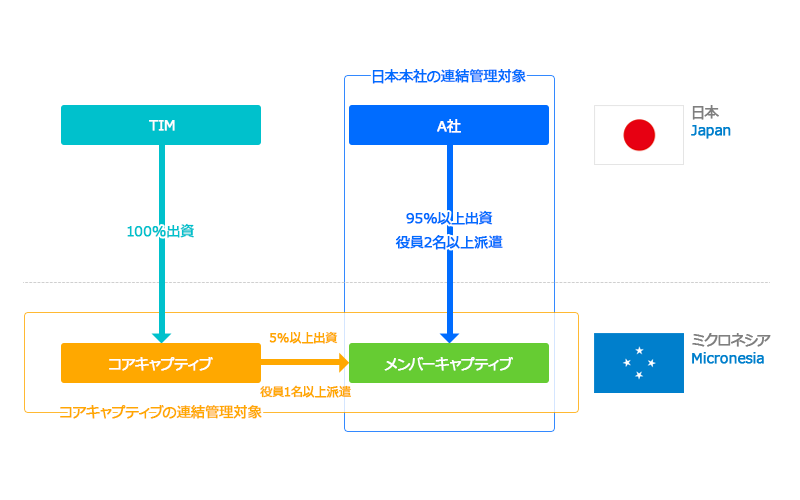

そして、キャプティブにて保有(自家保険化)されたリスクに関して、リスクマネジメント(事故低減活動等)を通じて損害率の低減(=収益性の向上)を図り、 自社及び自社グループのリスク移転コストの効率化を実現することが、キャプティブ設立の主な目的となります。 弊社では、キャプティブ会社を2社保有し、キャプティブ運営に実際に携わっております。

※1:海外所在の保険会社が本邦のリスクを直接引受けることは認められていない(海外付保規制)為、「保険会社の保険」である再保険契約を国内保険会社と締結して、キャプティブへのリスク移転を行います。